Equity and bond markets gave a big thumbs-up to the government’s “considered” decision to slash its borrowing requirement from Rs 50,000 crore to Rs 20,000 crore. Dalal Street participants said the move clearly signals improvement in revenue receipts that would ease worries over annual fiscal deficit for 2017-18.

Equity benchmarks of Bombay Stock Exchange and National Stock Exchange regained upside momentum, overcoming Tuesday’s losses amid easing yields on 10-year bonds after yesterday’s 10 basis points jump. In early deals in bond market today, yields posted the steepest decline in 14 months from 7.269 per cent to 7.212 per cent. (Bond yields and prices move in opposite directions).

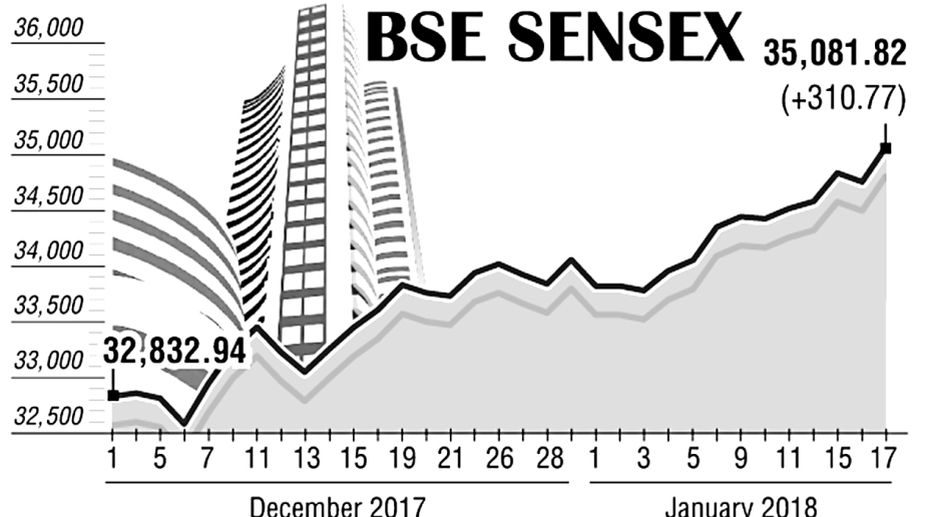

The 30-share Sensitive Index of BSE surpassed one more milestone of 35,000-level during intra-day trade today. The 50-share Nifty also moved apace on buying in broader market. The Sensex closed at record high of 35,081.82 points, registering an increase of 310.77 points or 0.89 per cent. The Nifty finished at 10,788.55 points, showing a jump of 88.10 points or 0.82 per cent.

Bank shares, particularly state-run lenders, took the Bank Nifty to 26,289.10 (+314.20) points, an increase of 1.21 per cent, while the PSU Bank Nifty ended the day with bigger gain of 4.17 per cent or 147.60 points at 3,690.90 points.

The BSE benchmark added nearly 1,000 points in nine trading sessions. It had closed at 34,153 points on 5 January and has been rising constantly irrespective of a couple of profit booking sessions.

Analysts say brokerages would be revising their Sensex and Nifty targets afresh in view of the booming pre-Budget rally which appears unprecedented considering repeated worries vented by experts over stretched valuations.

Another positive development pertains to GST Council’s expected decision to rationalise prices (indirect taxes) on more than 70 items of which 40 are linked to agriculture and rural economy. The council will be holding its last meeting before Budget 2018-19 is presented on 1 February.

This pre-Budget thinking, analysts say, hints at improvement in revenue receipts. The government has already stated nearly 18 per cent increase in direct tax collection in the fiscal so far. The finance minister, Mr Arun Jaitley, according to Dalal Street buzz, may not overshoot the 3.2 per cent fiscal deficit target for the current fiscal.

Foreign portfolio investors have turned net buyers in January despite four profit-booking sessions last week. Yesterday, they invested Rs 693.17 crore in domestic stocks, taking the month’s tally to Rs 1,499.37 crore, according to numbers available with the regulator and depositories.

Analysts say the cut in borrowing target also suggests the shortfall in indirect taxes or Goods and Services Tax or GST has been largely met. It would be interesting to know the latest GST collection figure which experts see crossing Rs 1 lakh crore or an increase between 15 and 20 per cent.

As bond yields eased, the partially convertible rupee, which closed at 64.04 against the United States dollar yesterday, recouped those losses and in early morning or intra-day trade appreciated 0.31 per cent to 63.77/$.

Bank shares, particularly state-run lenders, surged tracking cut in government’s borrowing requirement. Yesterday, lenders lost ground after Reserve Bank of India’s deputy governor Viral Acharya bluntly told lenders not to depend on financial regulator to manage their interest rate risks. The statement also hit the bond market.