BSE Sensex tanks 389 points, markets spooked by escalation in Middle East tensions

BSE Sensex is trading at 72,099 points, down 389 points on Friday as domestic equities continued their losing spree amid escalation in Middle East tensions.

Stocks of three main oil marketing companies, HPCL, BPCL and Indian Oil Corporation, slipped between 3 percent and 5.5 percent on Wednesday as global crude oil prices flared up — Brent Crude futures for July were up 2.5 percent at four-year high of $76.73 per barrel — post US President Donald Trump’s decision to withdraw from the multi-national nuclear treaty with Iran and his threat to impose fresh sanctions on Teheran.

Analysts see wider ramifications of the US step for major oil importing countries such as India.

Hindustan Petroleum share slipped 5.37 percent in morning deals to Rs 290.65, Bharat Petroleum then was trading at Rs 378.45, down 3.68 percent and IOC was 3.48 percent down at Rs 160.80. Analysts do not rule out further decline in OMC shares as they are also constrained on account of the government’s refusal to cut excise duty on fuels and protect consumers who are complaining about “unaffordable” petrol and diesel prices.

Advertisement

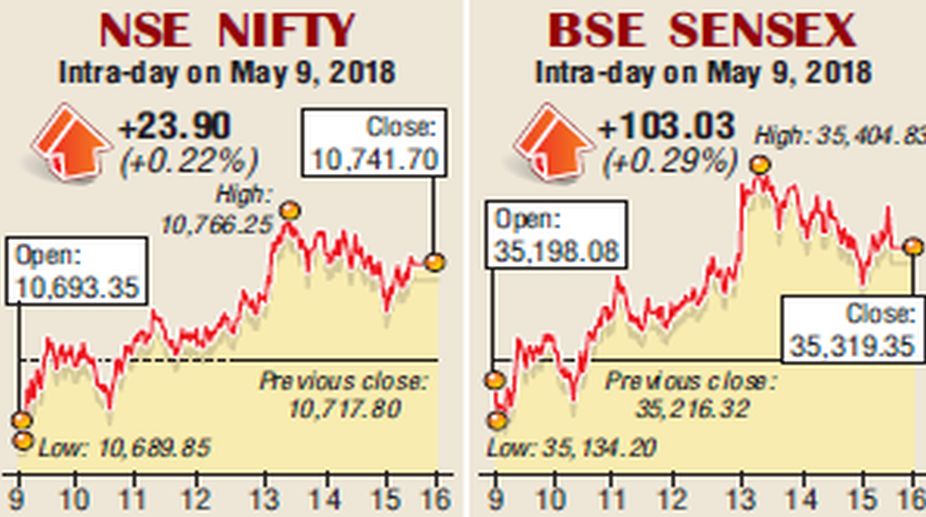

Undeterred by negative external factors, the equity benchmarks of Bombay Stock Exchange and National Stock Exchange kept upside momentum intact, holding on to their intra-day gains ahead of the release of consumer price index linked inflation, fiscal deficit guidance and manufacturing/ industrial activity data. Besides, market participants restricted themselves to stock specific action contributing to gains in main indices.

Analysts say economic macros are likely to meet experts expectations. As earnings season for Q4 2017-18 ends in a week, most brokerages claimed that the results have been in line with their estimates with very few exceptions.

This has been cited as the main reason for equity indices to keep ticking. Sensex ended 35,319.35 (+103.03) points up 0.29 percent.

Nifty at 10,741.70 (+23.90) points gained 0.22 percent. Indices gained in the afternoon trade on account of auto, IT, private banks and metal shares. Tata Motors increased more than 3 percent on impressive sales numbers of its UK subsidiary Jaguar Land Rover which in April sold 45,180 vehicles, an increase of 12 percent over previous year’s figure.

Bank Nifty was lifted by increase in private lenders’ stock prices to 26,154.45 (+63.95) point an increase of 0.25 percent. But Nifty PSU Bank was down 0.73 percent at 2,855.45 (-21.05) points. Dalal Street performed better than its Asia-Pacific peers, say analysts.

However, many brokerages are worried about crisis in global crude oil market and free falling partially convertible rupee which this morning opened 27 paise down at 67.37 per US dollar and slipped further.

Foreign portfolio investors on Tuesday were less active as they sold shares worth just Rs 97.15 crore against value buying of Rs 923.25 crore worth stocks by domestic institutional investors which enabled the market to end flat.

Analysts fear more withdrawal by FPIs if geopolitical situation worsens in weeks ahead. Money matter experts at Bank of America, Deutsche Bank, Yes Bank and Edelweiss predict the rupee falling to 70/$ by end 2018 on account of rising crude oil prices.

Angel Broking’s Mayuresh Joshi said, “Crude oil prices are trending with what the US has done in terms of the sanctions on Iran. The spike in oil prices obviously act negatively for OMCs. A curious element in relation to earnings hinges on two factors: the movement of crude and depreciation of the rupee against the dollar. Both these factors may eat into the earnings estimate for OMCs.”

In Sensex 19 shares advanced and 12 declined. For Nifty the ratio was 25: 25. Gainers in BSE benchmark included Tata Motors Rs 340.75, 2.60 percent; Asian Paints Rs 1,226, 1.69 percent; TCS Rs 3,485, 1.28 percent; Axis Bank Rs 548.10, 1.27 percent; and Yes Bank Rs 347.60, 1.24 percent.

Advertisement