Market extend losses on wide-spread selling amid Israel- Iran tensions

The losses were weighed on investors' risk appetite who will also closely track March quarter results at home.

Stock Market Intraday

Reliance Industries Limited, the second most valued company after TCS by market capitalisation, jumped to a fresh 52-week high to Rs 1,072.85 (up more than 3 per cent )in early deals on better earnings expectations by market participants.

RIL was to declare its numbers for Q4 ( January-March) post market hours on Friday. Analysts say the market is looking forward to quarterly performance of Reliance Jio Infocomm which reported Rs 504 crore net profit in the December quarter.

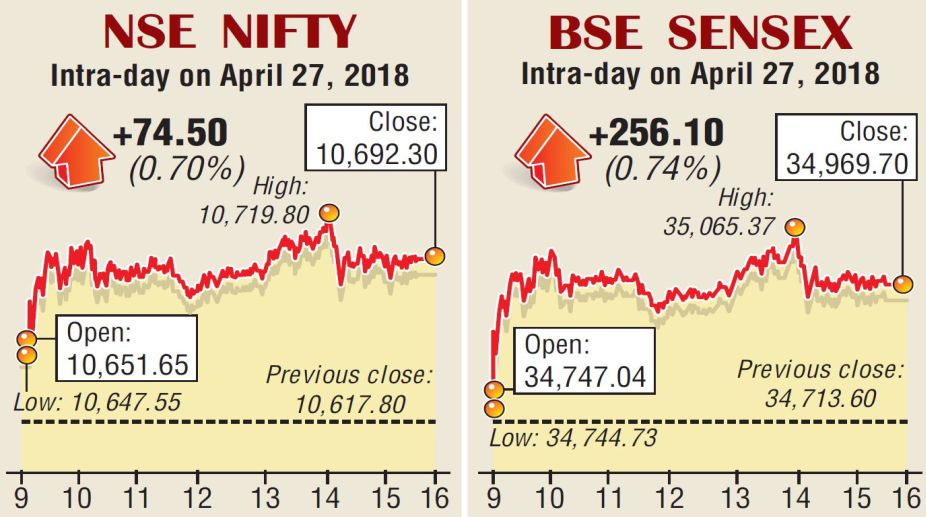

Besides RIL banking stocks rallied handsomely to lift the 30-share Sensitive Index of Bombay Stock Exchange above the 35,000 mark to 35,065.37 (+351,77) points and broader market’s 50-scrip Nifty of National StockExchange surpassed 10,700 level to touch 10,719.80 (+102) points for the first time in two months. Analysts attributed buoyancy in equity benchmarks to a robust earnings season after a a gap of several quarters.

Advertisement

The market retained its momentum undeterred by New York-based rating agency Fitch’s reaffirmation of BBB- sovereign investment rating on India regardless of a strong plea by the government to seek review of the rating that has been in place for 12 years. BBB- is considered the lowest rating. Fitch justified its reaffirmation citing fiscal and structural issues that are blocking the country’s upgradation. It has also maintained “stable” outlook and Fitch says that “broadly balances upside and downside risks to sovereign rating”.

Market analysts said Fitch’s decision did not come as a surprise to the market as the impression among market participants is “the US based agency has different parameters to judge India’s economy”.

They also pointed out that the market similarly remains “cool” to frequent statements — either positive or negative — from global agencies, including the World bank or International Monetary Fund.

The benchmarks continued to trudge along on encouraging earnings data. Top lenders such as Axis Bank, ICICI Bank, Kotak Mahindra, SBI were among major contributors to the day’s rally. Axis Bank which declared its first ever loss of Rs 2,189 crore in Q4 on Thursday rebounded from day’s low of Rs (-3 per cent) to top gainers list in the pre-noon session as the private lender said having made significant provisioning for the piled up non-performing assets or NPAs it expects asset quality to “normalise” in the current FY 2018-19.

This was backed by brokerages claiming “better days” ahead for Axis Bank as the lender may manage to clean up its balance sheet sooner than expected.

Axis Bank with allround impressive performance in Q4 as was revealed in earnings data on Thursday continued to rally on top billings by brokerages who said the bank thrived in solid credit growth in Q4.

Jefferies maintained “buy” with a revised target price of Rs 440 from Rs 415 earlier saying “asset quality surprised positively with 80 per cent recovery from FY17 divergences.

Citi too maintains “buy” rating as it raised stock’s target price to Rs 425 from Rs 400. It says “Yes Bank is well placed to deliver strong growth across segments. Low credit costs and stable net interest margin (NIM) should drive healthy profitability.” Morgan Stanley gives “overweight” rating to Yes Bank with a target price of Rs 400 saying “current valuations are also looking inexpensive”.

Overnight increase in the US market also on better quarterly earnings data eclipsed the rise in Treasury bonds as investors are being guided by corporate performance rather than collateral macros.

The Asia-Pacific markets also increased in tandem and the positive mood later spread to Dalal Street. MSCI ( Morgan Stanley Composite Index outside Japan) for Asia-Pacific gained 0.4 per cent. But six European exchanges were subdued because European Central Bank opted to keep interest rates unchanged. The Sensex closed for the week at 34,969.70 (+256.10) points gaining 0.74 per cent. Nifty increased 0.70 per cent to end 10,692.30 (+74.50) points. Nifty Bank and Nifty PSU Bank at 25,394.60 (+383.70) points and 2,814.90 (+103.05) points were up 1.53 per cent and 3.80 per cent respectively.

With just one trading session ( Monday) left in the month, foreign portfolio investors are expected to end as net sellers in April — for the second time in four months. FPIs until Thursday sold shares worth Rs 8,475.38 crore against March’s net buying of Rs 7,904.85 crore.

DIIs, on the other hand, continued to buy in April. They are net buyers of Rs 7,768.10 crore worth stocks until Thursday on the back of Rs 6,693.91 crore net investment in March.

In Sensex 20 shares advanced, 10 declined and one was unchanged. For Nifty it was 36:14. Gainers in BSE benchmark included Axis Bank Rs 537.60, 8.70 per cent; SBI Rs 243.35, 4.29 per cent; Tata Motors Rs 337, 2.03 per cent; and RIL Rs 994.25, 1.94 per cent.

Advertisement