Supportive global cues emanating from Friday’s strong end to American shares in Wall Street (Dow Jones ended 1.39 per cent up and Nasdaq gained 1.77 per cent) ensured that Asian markets too retain their upside momentum in the week’s first session on Monday.

Compared to other Asia-Pacific indices the domestic benchmarks 30-stock Sensitive Index of Bombay Stock exchange and 50-scrip Nifty of National Stock Exchange performed better as Dalal Street analysts look ahead to the release of macro data related to Nikkei PMI or purchasing managers index (demand and order books of manufacturing and a host of services sectors) and the latest feedback on fiscal deficit and GDP estimates.

An opinion poll by Reuters suggests GDP for October-December quarter is likely to be the best for 2017-18 at 6.9 per cent suggesting impact of demonetisation and Goods and Services Tax rollout has weakened further.

Analysts expect these numbers to be in line with the slight moderation in consumer price index or CPI inflation and decline in WPI or wholesale price index for January.

If these fundamentals expected to be out by Wednesday come up to the market’s expectations, the development may prove to be the trigger for the equity market which since last week has been witnessing buying by domestic institutional investors regardless of profit booking by foreign portfolio investors or FPIs.

On Friday, DIIs were net buyers of stocks worth Rs 1,514.03 crore while FPIs were net sellers of Rs 486.32 crore in equity. Their month’s tallies so far are ` 13,760 crore net buy and `14,842.26 crore net sale respectively.

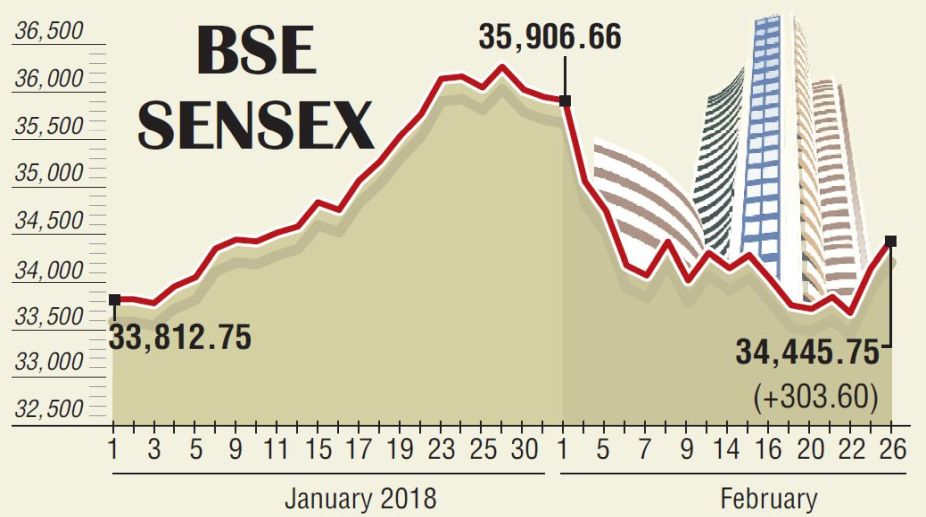

The Sensex stayed on course holding on to its intra-day gains as it increased 0.89 per cent to end 34,445.75 (+303.60) points. The broader market’s Nifty ended 0.87 per cent up at 10,582.60 (+91.55) points.

In Bank Nifty the rally was led by private lenders such as ICICI Bank, HDFC Bank and Kotak Mahindra Bank. State-run lenders were subdued, still reeling under the impact of the `11,400 crore Punjab National Bank letter of undertaking fraud.

Oriental Bank of Commerce cracked nearly 12 per cent after Central Bureau of Investigation filed an FIR against Delhi-based jeweller who allegedly defrauded OBC of `390 crore. Nifty Bank rose 1.62 per cent closing 25,687.90 (+385.40) points. Nifty PSU Bank declined 0.70 per cent at 3,167.80 (-22.45) points. In Sensex 24 stocks ended up and seven down, for Nifty it was 38:12.

Still unclear about whether or not the market stands correction in the aftermath of the recent 7 per cent or more fall in benchmarks, Kotak Institutional Equities’ note says, “For Nifty we expect 26 per cent earnings growth for March 2019 and 16 per cent March 2020. If the macros deteriorates further and earnings numbers disappoint then we could actually see market coming down from current levels .”

As global equity markets signal gradual recovery from the adverse impact of jump in bond yields across all main economies, difference of opinion exists among agencies/individuals whether or not debt market volatility has subsided.