Stock market bounces back; banks, metals shine

Sensex was up 599.34 points, or 0.83 per cent at 73,088.33, while the Nifty was up 151.20 points or 0.69 per cent at 22,147.

Stock Market Intraday

After three straight sessions of heavy bear pounding, equity benchmarks of Bombay Stock Exchange and National Stock Exchange were very much on track to recover on account of value buying and short covering but late in the day volatility generated by a spell of profit booking frittered away the day’s gains, robbing Dalal Street of its much wanted relief rally that would have changed investors’ mood ahead of Thursday’s expiry of F&O derivatives contracts for February.

The early upside after a tentative start was due to buying in IT and metal segment. State-run bank shares that were under pressure managed to overcome selling pressure enabling gains in Nifty Bank of NSE and Nifty PSU Bank. However, Nifty bank lost ground while Nifty PSU Bank managed to stay afloat. Most selling was seen in private sector lenders.

Considering monthly expiry of F& O series and after the impact of Punjab National Bank’s $1.88 billion fake letter of undertaking or LoUs issued by it to off shore branches of other lenders , analysts say, will continue to last for the rest of the week. Brokerages also cite overall decline in global equity indices from United States to Asia and Europe.

Advertisement

The markets are desperate for a positive trigger which currently appears to be elusive. Analysts say until the fiscal damage control measures by the government and Reserve Bank of India in the $ 1.88 billion letter of undertaking (LoU) fraud shows results the market may continue to reel under strong negative bias.

The 30-share Sensitive Index of BSE and 50-scrip Nifty of NSE traded with upside bias bucking the downside trend witnessed in other Asian markets but could not thrive as the rally was cut short by volatility.

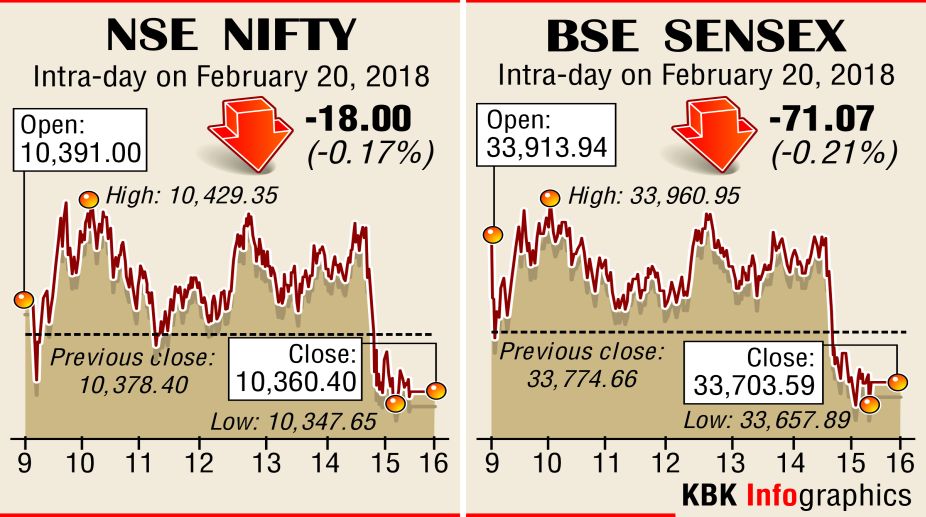

The ongoing correction set off by the imposition of Long Term Capital Gain Tax in the Budget 2018-19 has prolonged after the PNB bank fraud came to light last week. Under volatile conditions the Sensex ended 0.21 per cent down at 33,703.59 (-71.07) points.

Nifty declined 0.17 per cent to close 10,360.40 (-18) points. Day’s highs for Sensex and Nifty were 33,960.95 (+186.29) points and 10,429.35 (+50.95) points respectively. Nifty Bank at 24,874.40 (-184.15) points lost 0.73 per cent while Nifty PSU Bank managed to end in green with 0.83 per cent gain at 3,136.55(+25.90)points.

In Sensex 18 stocks moved up and 13 down. For Nifty the ratio was 27:22:1.

According to the Securities and Exchange Board of India’s latest data available till Monday, foreign portfolio investors or FPIs had sold stocks worth `6,579.4 cror while domestic mutual funds were net buyers in equity of `5,351.96 crore.

Analysts say FPIs book profit and MFs picked up stocks selectively on dips called value buying.

Gainers in BSE benchmark included Bharti Airtel `419, 1.13 per cent; SBI `270, 0.88 per cent; TCS Rs 2,945.40, 0.71 per cent; and Tata Steel `652.80, 0.70 per cent. Axis Bank was down 1.42 per cent at `531.80; and Kotak Mahindra `10,43.10, -1.27 per cent.

Advertisement