New set of regulation for deepfake soon, says Ashwini Vaishnaw

Union minister Ashwini Vaishnaw on Thursday said a new set of regulations will be designed soon to deal with the ill use of deepfake technology.

(PHOTO: SNS)

The Indian Media and Entertainment industry is on the cusp of a strong phase of growth driven by increasing digitisation and higher Internet usage. The gaming industry that comprises of a large chunk is at an inflection point having seen exponential growth over the last decade.

According to NASSCOM, the Indian gaming sector is close to $300 million.Video games are becoming a major part of modern culture and have now become one of the most popular forms of entertainment. Factors such as a large young population, rising disposable incomes, increasing Smartphone users, 3G and now the roll-out of 4G services providing an efficient high-speed data networks to mobile gamers are all aiding to the fast growth.

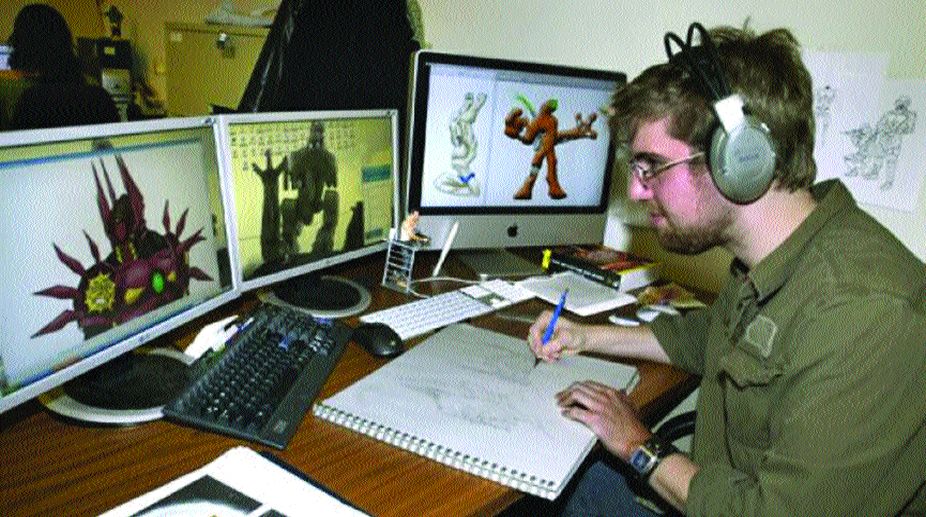

This industry offers various career options in design, gamer art, animation and programming. India in fact has the potential to be the next big thing in terms of game process outsourcing for major overseas companies. The aspiring students need to educate themselves about the required skill-sets. But, the problem would be how to get to know the details of what happens in each of these areas and how one can prepare for the same. And this is where some research into what goes on in the gaming industry would help.

For game design, one could consider undertaking a course at specialised institutes though most are self-taught. Those wanting to learn programming would be well advised to enroll in a good computer science programme.

There are plenty of resources available on the Internet. For those who go to regular institutes it would be helpful to work at some game art development studio as an intern and get intimately familiar with the tools and processes. They must possess a natural urge to create art and have a passion for video games. The growth is immense and all depends on talent, skills other factor as well.

Gaming also offers opportunities in different functional areas such as game testing, project management and other general management areas. Today, game creation is a much evolved field of art involving various specialised workflows. Generally, students aiming for this industry should have excellent skills in low to mid polygon modelling in Autodesk Maya/Max, high resolution sculpting in Zbrush/Mudbox, creating high quality diffuse texture, baking various texture maps and working understanding of a current generation Game engine, like Unreal Editor or Crytek engine or Unity 3D.

In addition to this it would be helpful if they are familiar with Physically Based Rendering workflow as most of the current generation game engines have switched to this method. Apart from this, a fair understanding of how to create lower levels of detail for an existing game content is of great importance.

THE WRITER IS CHIEF EXECUTIVE OFFICER,

LAKSHYA DIGITAL

Advertisement

Advertisement