Art for a post-truth world

Treasures from the Wreck of the Unbelievable – Damien Hirst’s decade-in-the-making Venetian extravaganza – is as unbelievable as his title…

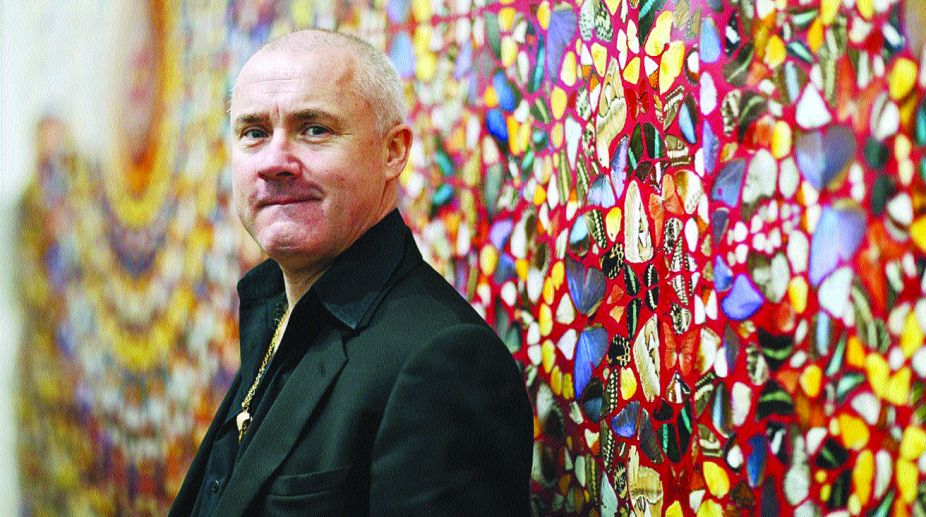

Imagine the Rolling Stones coming out with a new acoustic album or Christo preparing to wrap some remote island in parachute fabric. That is the kind of anticipation that surrounds artist Damien Hirst’s first new body of work in several years, to be unveiled in Venice on 9 April, a month before the Biennale there. The show, billed as “10 years in the making”, is also the first time the Pinault Collection’s two locations — the Palazzo Grassi and the Punta della Dogana — will be dedicated to a single artist.

Like previous Hirst extravaganzas, this project is being rolled out with the same hyper-vigilant level of control and fanfare. And hovering over the project is whether — given the precipitous drop in his prices after his all-Hirst Sotheby’s auction in 2008 — the celebrity artist can have another chapter.

Has the art-world darling of the 90s — who led the so-called Young British Artists, or YBAs, and was known for his $12 million shark in a tank — jumped the shark? And given that many buyers were left bitterly holding the bag after Hirst flooded the market with his work at the Sotheby’s sale, doing an end run around his dealers, will collectors give him another chance?

Advertisement

“He’s certainly confounded the market before. It depends on how successful the work is,” said Marc Porter, a chairman of Sotheby’s fine art division. “He’s taking on Venice and that’s audacious.”

The project, Treasures From The Wreck Of The Unbelievable, according to those who have glimpsed it, resembles jewelled buried treasure covered with coral as if just pulled out of the ocean, like relics from the lost city of Atlantis or Captain Nemo. It includes some 250 pieces in various sizes ranging in price from about $400,000 (S$567,500) for small jade objects to $4 million for a malachite head of Medusa.

Potential buyers cannot view the work in person, nor can they receive images by email, a courtesy typically afforded top collectors. Instead, a representative from one of Hirst’s two galleries — Gagosian in New York and White Cube in London — visits with an iPad to flip through photographs of the work. Hirst declined to comment, as did his dealers, Larry Gagosian and Jay Jopling of White Cube, who said all news media requests had to go through Hirst’s studio, Science UK Limited. (The Pinault Collection’s owner, François Pinault, also refused to be interviewed; his museum has posted just a couple of tantalising photographs of Hirst’s coming show on its website). The Venice show is the third prong of Hirst’s apparent stab at a second act. The first was his opening of the Newport Street Gallery in south London in October 2015, which presents exhibitions of work from his collection. Then in April, Hirst, 51, announced that he was returning to the high-powered Gagosian gallery, having left it in 2012. Already his market is showing signs of strengthening. One of his large butterfly canvases sold at Christie’s in November for a respectable $1 million, given the estimate of $900,000 to $1.2 million. Just about everyone in the art world agrees that Hirst has some healing to do. While he pulled off the unthinkable by selling $200 million of his work at the Sotheby’s sale on 15 September 2008 — bypassing the usual gallery channels and on the same infamous day that Lehman Bros. declared bankruptcy — the result was a surfeit of Hirst pieces on the market, which hurt his prices.

“In many ways that auction marked the beginning of the end,” dealer Helly Nahmad said. Where his pill cabinet Lullaby Spring sold at Sotheby’s in 2007 for US$19.2

million, for example, his pill cabinet Lullaby Winter sold at Christie’s in 2015 for US$4.6 million. More recently, one of his spot paintings sold in Sotheby’s contemporary art day sale in November for just US$396,500, considerably lower than the US$1.7 million they sometimes fetched in 2013.

“People inexplicably bought into that sale, precipitating a downward market death spiral that took us all down with them,” said Adam Lindemann, the collector and dealer, referring to Hirst’s all-Hirst Sotheby’s auction. “His market collapsed and hasn’t really revived since.

“And now he’s back like Arnold,” Lindemann continued, referring to a line from Arnold Schwarzenegger’s Terminator films. “Remember the old saying, ‘Fool me once shame on you, fool me twice shame on me.’”

Because Hirst is so prolific, there is the growing sense that his works are ubiquitous, an impression that would be countered, collectors say, by a catalogue raisonné that offered a full accounting of his work.

“As an investor, which I am, before undertaking such an investment you have to really make sure that the production is somewhat under control,” Nahmad said. “The market doesn’t like chaos and the market doesn’t like confusion. If Damien Hirst came out with an extensive catalogue raisonné, people could see an order to his body of work. How many units exist? How many butterflies? How many spot paintings?”

At the same time, art experts say, Hirst is the real deal — not just a flash in the pan or a relic of the past, but an artist with exceptional talent and staying power.True, he had the temerity to charge US$100 million for a diamond encrusted skull in 2007 and to take over all of Gagosian’s galleries in 2012 (11 of them at the time) with a retrospective of his spot paintings. But Hirst, collectors, dealers and auction executives say, is worthy of attention, as evidenced by the Tate Modern’s decision to devote a retrospective to his work in 2012.

“He is still one of the greatest artists of this century,” said real estate developer Aby Rosen, who described himself as “long on Hirst” in his art collection, calling the new Treasures work “stunning”. “He will produce till he dies because he has so much brain — he’s so deep,” Rosen added. “And this guy is not going away.”

As to whether collectors unable to sell their Hirsts had a right to be frustrated, Rosen said: “If you want to be a collector, you have to collect wide and deep, and within your portfolio things will go up and down. If you buy two stocks and one goes down, don’t be angry at IBM or GM.” There are those who say that Hirst’s coming shows in Venice are inextricably linked with Pinault, who owns Christie’s auction house and has avidly collected Hirst’s work. Does he want to jump-start the Hirst market out of self-interest, art experts ask, to raise the value of his own holdings?

Whatever the case, most agree that Hirst — with an estimated net worth of US$350 million — doesn’t need the money. “I do believe that Damien Hirst — especially early Damien Hirst — will have an important footprint in art history,” Nahmad said. “The true die—hard Hirst collectors, if they love what he’s doing now, they’ll buy into it and disregard that this guy so many times in the past has way overproduced.” Perhaps more than any other artist, Damien Hirst has embodied the meteoric rise of the artist as celebrity, the auction market at its height and collectors competing to pay millions for a stuffed shark or flattened butterfly. But as art has increasingly become an asset class, Hirst has also come to symbolize how a high—flying stock can tank.

Here’s a look back at some of the critical junctures in the volatile yet rivetting trajectory of Hirst.

1991: Formaldehyde Hirst takes the art world by storm with his tiger shark suspended in formaldehyde, which billionaire hedge-fund manager Steven A Cohen buys for a reported US$12 million.

1990s: Butterflies Hirst explores themes like death and science with butterflies pinned under glass.

2000s: Pill Cabinets Hirst’s coloured, handmade pills recall Victorian curiosity cabinets and explore modern notions of medicine.

2007: Luxe Skulls Hirst announces sale of his diamond-encrusted skull for US$100 million.

2008: Hirst Sotheby’s Sale Brings US$200 Million. Hirst bypasses dealers to sell all 223 works, breaking the record for a single-artist auction, set in 1993 when an 88-work Picasso sale brought US$20 million.

2009-17: After his Sotheby’s sale, Hirst’s prices at auction top out at US$1.5 million (for his Mickey canvas at Christie’s London in 2014) and eventually fail to sell (his Beautiful Mickey Mouse Painting, estimated at US$400,000 to US$600,000 at Christie’s in May 2015).

January 2012: Spot Paintings Everywhere — Larry Gagosian agrees to show Hirst’s spot paintings in all of his 11 galleries.

December 2012: Hirst stuns the art world by announcing that he is leaving the Gagosian gallery, where he has been represented for 17 years.

2016: Hirst And Gagosian reunite — four years after leaving Larry Gagoisan, Hirst returns to the gallery. “I share a long history with Larry,” the artist says in a statement, “and am pleased we are working together once again.” Gagosian says, “Take Damien Hirst out of contemporary art history, and there’s an incredible void. Great artists, like great people, have second acts.”

2017: Hirst to unveil a new work At Pinault Collection in Venice. Ten years in the making, Hirst’s exhibition is to open just before the Venice Biennale, the first time that the two Venetian locations of the Pinault Collection will be dedicated to a single artist.

The Straits Times/ANN

Advertisement