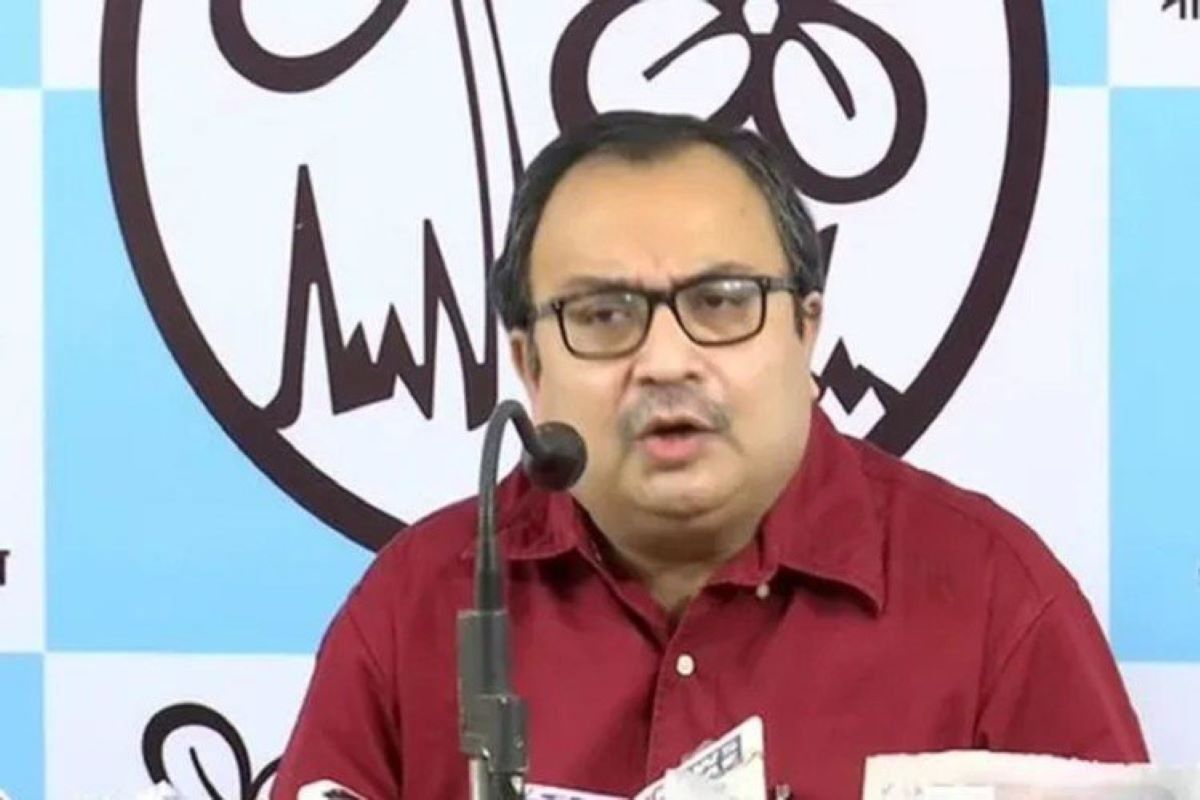

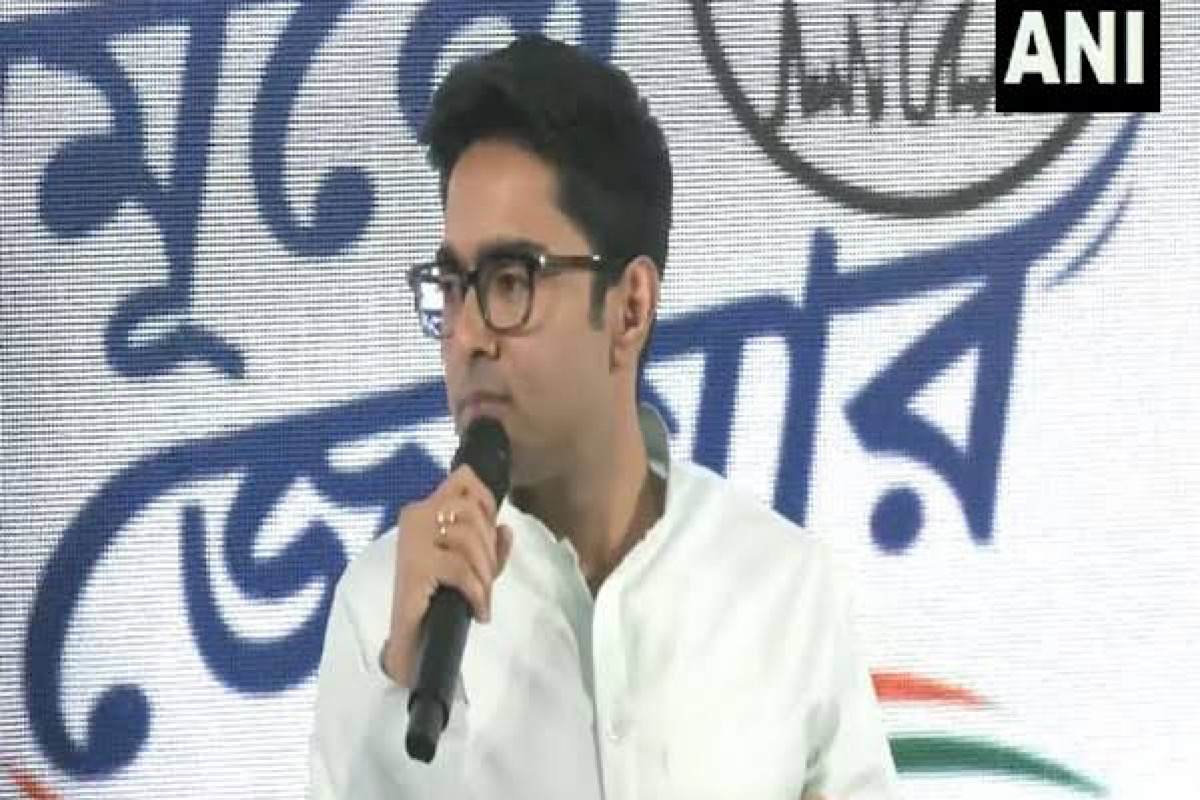

Drive out BJP to prevent UCC implementation: CM

As the BJP advocates the vision of one nation, one election and views the implementation of a Uniform Civil Code (UCC) as imperative for the nation's welfare, chief minister Mamata Banerjee today urged the people to drive out the BJP so that it cannot implement the UCC.